Thursday, 17 January 2013

Term Deposit growth and low interest rates

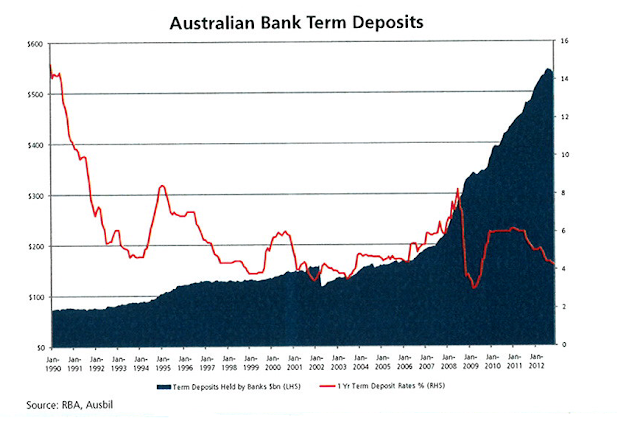

As can be seen from the graph below the rapid growth of term deposits since the Global Financial Crisis in Australian bank term deposits has almost been threefold from just under 200 billion to around 550 billion. The irony being the term deposit rate, except for a very short period in 2008, has been very low indicating the investment has not been based on the return being offered but rather the safety of getting your money back. With these rates now below the 20 year average will this large supply of funds remain in this asset class or find another area offering a higher level of income such as shares or property. Only time will tell given the fears of America's debt and the Eurozone debt crisis however as these fears subside pressure will mount for retirees to look for more income.

Subscribe to:

Comments (Atom)